It’s January 2026. You’ve got a fresh calendar, maybe a few holiday credit card charges you’d rather not think about, and that familiar feeling: This is the year I finally get my money together.

I’ve had that thought every January since I was 23.

Most years, it lasted until about January 15th. Then life happened -an unexpected car repair, a birthday I forgot about, that one subscription I swore I cancelled -and the budget went straight into the trash.

But here’s what changed everything for me: I stopped trying to build the “perfect” budget and started building one that could survive real life.

I started with $16,000 in debt on a $45,000 salary. No trust fund. No side income. Just a desperate need to stop the bleeding.

This guide is what I wish someone had handed me back then. Real templates. Real numbers. Real strategies that work when you’re starting from zero -or less.

Why Most New Year Budgets Fail by February

Let’s be honest about what we’re up against.

According to recent data, 55% of Americans live paycheck to paycheck in 2025 -and that includes households earning over $100,000. The median American household spends roughly $6,440 per month. When you factor in that 60% of workers couldn’t cover a $1,000 emergency from savings, the math gets brutal fast.

Here’s the thing most budget advice ignores: you can’t save your way out of a spending problem if the problem is that there’s nothing left to save.

Most budgets fail because they’re built for people who already have margin. They assume you have money left over at the end of the month to “allocate.” They tell you to “pay yourself first” without explaining what happens when you literally can’t.

If you’re stuck in that cycle and wondering how a budget can possibly help when there’s no money to budget, start with 5 tips to stop living paycheck to paycheck. Then come back to these templates with a clearer foundation.

The budget system I’m sharing works differently. It starts with what you actually spend, acknowledges that life will punch you in the face, and builds in the flexibility to roll with it.

The Real Math: Where Your Money Actually Goes

Before we talk about budgeting, let’s talk about where money typically disappears.

The average American household breaks down roughly like this each month:

| Category | Monthly Cost | % of Income |

|---|---|---|

| Housing | $2,050 | 32% |

| Transportation | $1,060 | 16% |

| Food | $810 | 13% |

| Healthcare | $560 | 9% |

| Insurance | $470 | 7% |

| Entertainment | $250 | 4% |

| Other | $1,240 | 19% |

Here’s what jumps out: housing and transportation alone eat nearly half of most people’s income. That’s before you’ve bought groceries or paid for health insurance.

If you’re spending 50% of your take-home on just getting to work and having a place to sleep, there’s not much left to “budget” with traditional methods.

This is why I focus on the controllables -the categories where small changes actually move the needle -while accepting that some costs are essentially fixed in the short term.

Your 2026 Budget Framework: The Survival-First Approach

Forget the 50/30/20 rule. That’s designed for people who aren’t fighting to break even.

Instead, here’s the framework that got me from $16K in debt to $13,000 saved in my first year:

The Survival-First Budget:

- Fixed Survival Costs (housing, utilities, minimum debt payments, insurance)

- True Necessities (food, transportation, healthcare)

- The Buffer (even $25/month matters)

- Everything Else (whatever’s left -this is your actual discretionary spending)

The key insight: most people budget in reverse. They start with what they want to save, then try to squeeze everything else around it. When that doesn’t work, they feel like failures and quit.

The Survival-First approach starts with reality. What do you have to pay to keep the lights on and food on the table? That’s your baseline. Everything else is negotiable.

If you’re brand new to budgeting and want a step-by-step walkthrough before diving into these templates, start with budgeting for beginners in 6 easy steps. It covers the basics so you can tackle the 2026 templates below with confidence.

Real Budget Templates for Real Incomes

Let me show you what this looks like with actual numbers. I’m using take-home pay (after taxes and deductions) because that’s the money you actually see.

Template 1: $45,000 Salary (≈$2,900/month take-home)

This was my exact starting point. No room for error.

| Category | Amount | Notes |

|---|---|---|

| Housing | $1,015 | 35% - tight but manageable |

| Utilities | $150 | Electric, water, internet |

| Transportation | $350 | Car payment OR gas + insurance |

| Groceries | $300 | $75/week, meal prep required |

| Minimum Debt Payments | $200 | Credit cards, student loans |

| Phone | $50 | Prepaid carrier |

| Healthcare | $100 | If not covered by employer |

| Buffer/Emergency | $25 | Non-negotiable, even this small |

| Remaining | $710 | For everything else |

That $710 “remaining” covers: gas, personal care, clothing, entertainment, subscriptions, gifts, and any unexpected costs.

It’s tight. I know. But here’s what I learned: when you can see exactly where every dollar goes, you stop wondering why you’re broke. You know. And knowing is the first step to fixing it.

That grocery line item is critical - at $300/month, you’re looking at $75/week. That requires serious meal planning on a budget and sticking to easy frugal meals to make it work.

Template 2: $65,000 Salary (≈$4,100/month take-home)

More breathing room, but still requires intention.

| Category | Amount | Notes |

|---|---|---|

| Housing | $1,230 | 30% - hitting the recommended target |

| Utilities | $175 | Slightly larger place = higher bills |

| Transportation | $450 | Reliable car payment + insurance |

| Groceries | $400 | $100/week, some flexibility |

| Minimum Debt Payments | $300 | Accelerating payoff |

| Phone | $50 | Still no need for flagship plan |

| Healthcare | $150 | HSA contribution if available |

| Buffer/Emergency | $200 | Building real cushion |

| Remaining | $1,145 | Actual discretionary spending |

At this income level, you can start making choices. That extra $200/month to the buffer? It builds to $2,400/year -enough to handle most emergencies without going back into debt.

Template 3: $75,000 Salary (≈$4,700/month take-home)

This is where the math starts working in your favor -if you don’t lifestyle creep.

| Category | Amount | Notes |

|---|---|---|

| Housing | $1,400 | 30% - could be lower to accelerate goals |

| Utilities | $200 | Full service package |

| Transportation | $500 | Newer reliable vehicle |

| Groceries | $450 | Quality food, still mindful |

| Debt Payments | $400 | Aggressive payoff mode |

| Phone | $75 | Flexibility for better plan |

| Healthcare | $200 | Max HSA contribution |

| Buffer/Emergency | $400 | Serious wealth building |

| Remaining | $1,075 | Lifestyle spending |

The trap at this income: the $1,075 “remaining” feels like a lot. It’s not. That’s what covers everything from car repairs to vacations to birthday presents to “I had a rough day” takeout.

The real opportunity is that $400/month buffer. That’s $4,800/year going toward your financial foundation instead of disappearing into “where did it all go?”

The Tools That Actually Help (And the Ones That Don’t)

I’ve tested probably 15 different budgeting apps over the years. Here’s my honest take:

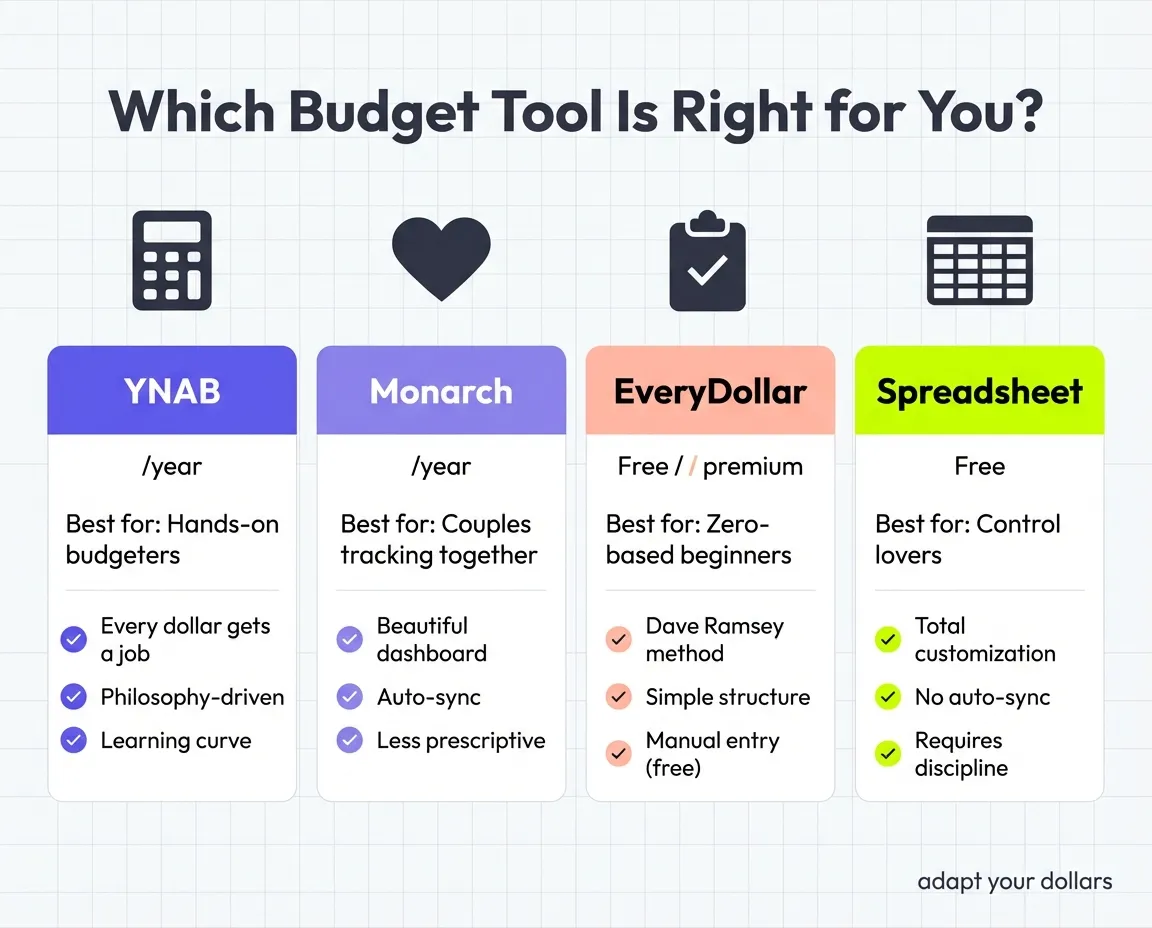

YNAB (You Need A Budget) - $14.99/month or $99/year

- Best for: People who want to be hands-on with their money

- The approach: Every dollar gets a job before you spend it

- My experience: This is what finally made budgeting click for me. The learning curve is real -maybe 2-3 weeks to really get it -but the philosophy changes how you think about money.

- Downside: The subscription cost feels steep when you’re broke. But if it saves you from one overdraft fee, it’s paid for itself.

Monarch Money - $14.99/month or $99/year

- Best for: Couples who need to see everything in one place

- The approach: Automatic syncing with clean dashboards

- My experience: Beautiful app, works well for tracking. Less prescriptive than YNAB about methodology.

- Downside: Similar price to YNAB with less “philosophy.” Good for tracking, not as good for behavior change.

EveryDollar (Free version) - Free or $79.99/year for premium

- Best for: Zero-based budgeting beginners

- The approach: Dave Ramsey’s method in app form

- My experience: Good starting point if you want structure without complexity. The free version requires manual entry, which some people find tedious and others find useful for awareness.

- Downside: Premium features feel overpriced. Free version does 80% of what you need.

Spreadsheets (Google Sheets/Excel) - Free

- Best for: Control freaks and people who don’t trust apps

- The approach: Whatever you build

- My experience: I started here. Still use a spreadsheet alongside my budgeting app for big-picture planning.

- Downside: Requires more effort. No automatic syncing. Easy to stop updating.

My actual recommendation: If you’re just starting, use EveryDollar free or a simple spreadsheet for 2-3 months. Learn your patterns. Then decide if YNAB’s methodology makes sense for you.

The best budget app is the one you’ll actually use. I’ve seen people succeed with sticky notes on their fridge. The tool matters less than the consistency.

The Bi-Weekly Budget Reality

If you get paid every two weeks -and most people do -here’s the truth nobody tells you: you have to budget differently than monthly planners assume.

Getting paid bi-weekly means you get 26 paychecks per year, not 24. Two months each year, you get three paychecks instead of two. This is both a trap and an opportunity.

The Trap: Most monthly bills don’t care about your pay schedule. Your landlord wants rent on the 1st whether you got paid on the 3rd or the 15th. This mismatch causes more overdrafts than almost anything else.

The Opportunity: Those two “extra” paychecks are found money if you budget for 24 paychecks and treat the other two as bonuses.

Here’s how I handle it:

- Calculate your monthly income using 2 paychecks only (annual salary ÷ 26 × 2)

- Budget based on that number

- When a three-paycheck month hits, that third check goes straight to: emergency fund, debt payoff, or a specific savings goal

For a $45,000 salary, that’s roughly an extra $1,730 twice a year -$3,460 total that most people accidentally spend because they never realized it was “extra.”

2026-Specific Tax Considerations

Quick hits on what’s relevant for your 2026 budget planning:

Standard Deduction for 2026:

- Single filers: $15,000

- Married filing jointly: $30,000

- Head of household: $22,500

Retirement Contribution Limits:

- 401(k): $23,500 (or $31,000 if you’re 50+)

- IRA: $7,000 (or $8,000 if you’re 50+)

- Catch-up contributions for ages 60-63: up to $11,250 additional for 401(k)

Why this matters for budgeting: If your employer matches 401(k) contributions, that’s free money you’re leaving on the table if you don’t contribute at least to the match. Even $50/paycheck adds up -and reduces your taxable income.

The new SECURE 2.0 provisions also mean more flexibility for emergency withdrawals from retirement accounts in 2026, though this should be a last resort, not a budgeting strategy.

The $25 Game-Changer

Here’s the hack that actually worked for me, and it’s embarrassingly simple:

Auto-transfer $25 from checking to savings every payday.

That’s it. $25.

At $45K, that felt like money I couldn’t afford to move. But here’s what I realized: $25 wasn’t making or breaking any single week. I never actually noticed it missing. But after a year, I had $650 saved without thinking about it.

Not life-changing money. But enough to cover a minor car repair without putting it on a credit card. Enough to stop the bleeding.

Once that felt normal, I bumped it to $50. Then $100. Then I started adding the same trick to my retirement account.

The secret isn’t the amount. It’s the automation. You can’t spend what you never see. And small amounts compound -both financially and psychologically.

After that first year of automated $25 transfers, I went from feeling like saving was impossible to having proof that I could do it. That mindset shift mattered more than the $650.

Financial experts recommend 3-6 months of expenses in an emergency fund. That can feel impossible when you’re starting from zero. But even $650 is infinitely more than $0. If you want to calculate how much emergency fund money you actually need for your situation, we’ve got a complete breakdown with real numbers.

Month-by-Month Expense Reality Check

One more thing most budgets ignore: expenses aren’t the same every month.

Here’s what actually happens throughout the year:

| Month | Higher Expenses | Why |

|---|---|---|

| January | Heating, post-holiday bills | Weather + December’s choices |

| February | Often lower | Short month, post-holiday recovery |

| March | Variable | Tax prep costs, spring clothing |

| April | Taxes, spring expenses | If you owe, it hits hard |

| May | Social events, gifts | Graduation, Mother’s Day, weddings start |

| June-August | Utilities, travel, kids’ activities | Summer peak everything |

| September | Back-to-school, restart costs | Kids or personal development |

| October | Variable | Often a recovery month |

| November-December | Peak everything | Holidays, heating starts |

The smart play: Use lower months (February, October) to build buffer for high months. Don’t budget the same amount for everything every month unless your life is unusually consistent.

What to Do Right Now

You’ve read this far. Here’s how to actually start:

Today (15 minutes):

- Check your last bank statement

- Write down your actual take-home pay

- List your truly fixed expenses (rent, car payment, insurance minimums)

- Subtract. That number is your reality.

This Week:

- Pick ONE category to track manually -just groceries, or just eating out

- Set up one auto-transfer, even if it’s $10

- Download one budgeting app and connect your accounts (or start a spreadsheet)

This Month:

- Complete one full month of tracking

- Review what actually happened vs. what you expected

- Adjust categories based on reality, not wishes

The Ongoing Practice: The goal isn’t perfection. It’s awareness.

I still go over budget in some category almost every month. The difference is now I know which category and I can adjust others to compensate.

That’s what a budget that works actually looks like: not a rigid plan that makes you feel like a failure, but a flexible system that helps you make real-time decisions with actual information.

The Real Talk

Building a budget from scratch -especially when you’re starting from zero or less -isn’t about willpower or discipline or any of that motivational poster stuff.

It’s about math and systems.

The math is simple: money in minus money out equals your reality.

The systems are what make it sustainable: automation that saves before you can spend, tracking that shows you the truth, and enough flexibility that one bad week doesn’t blow up your whole month.

I went from $16,000 in debt to $13,000 saved in my first year of taking this seriously. Now I’m past $200,000 in net worth. The strategies haven’t changed much. The numbers just got bigger.

The first year was the hardest -and the most important.

You’re one decision away from starting. Not a perfect decision. Not an optimized decision. Just the decision to track one thing, automate one small transfer, and see where you actually stand.

That’s it. That’s the whole secret.

The rest is just time and consistency.

What’s your biggest budget struggle heading into 2026? Drop it in the comments -I read every one and might cover your specific situation in a future post.

Written by

Chris

I went from checking my bank balance before every grocery run to building a $10K emergency fund. Now I share the exact strategies that worked—no jargon, no judgment.