I tried extreme frugality once. Obsessed over hitting exact weekly budget numbers, tracked every dollar, stressed over pennies.

Saved some money. Lost my mind.

The problem wasn’t the frugality—it was that I didn’t know when to stop. I cut everything, micro-managed the small stuff, ignored the big wins. Every week I’d beat myself up for going $8 over budget on groceries while ignoring my $400 car payment.

Here’s what I learned: Extreme frugality works when you have guardrails. When you know which cuts move the needle and which ones just make you miserable. When you treat it like a sprint, not a lifestyle.

Groceries are up 28.2% since 2019. Car ownership costs $11,577 per year. Most Americans are saving just 4.7% of their income. The pressure to cut spending is real, and you’re probably already doing everything you can think of.

But here’s the thing—most people focus on the wrong stuff. They stress over $4 lattes while ignoring $400 car payments. They meal prep to save $30/week but keep cable at $147/month.

This guide ranks extreme frugal tactics by actual ROI. You’ll see three real budgets showing what 38-45% savings rates actually look like. And you’ll get the guardrails I wish I’d had—so you can cut ruthlessly without losing your mind.

Extreme vs. Aggressive: Know Which One You Actually Need

Let’s define terms because “extreme frugal” gets thrown around like confetti.

Moderate frugality: You cut spending to 80-85% of typical American levels. You cook most meals, avoid impulse buys, shop sales. Comfortable but intentional.

Aggressive frugality: You’re at 70-75% of typical spending. One car instead of two. No cable. ALDI over Whole Foods. This is where most people should live.

Extreme frugality: You’re at 60-70% or lower. Roommates. No car. Beans and rice. Library for entertainment. This is a temporary tool, not a permanent lifestyle.

The truth is, most people need aggressive, not extreme.

Extreme is for specific goals—paying off debt fast, saving for a house down payment, surviving a job loss. It’s a sprint. Not a marathon.

If you’re thinking about going extreme, ask yourself: What am I sprinting toward, and how long can I sustain this?

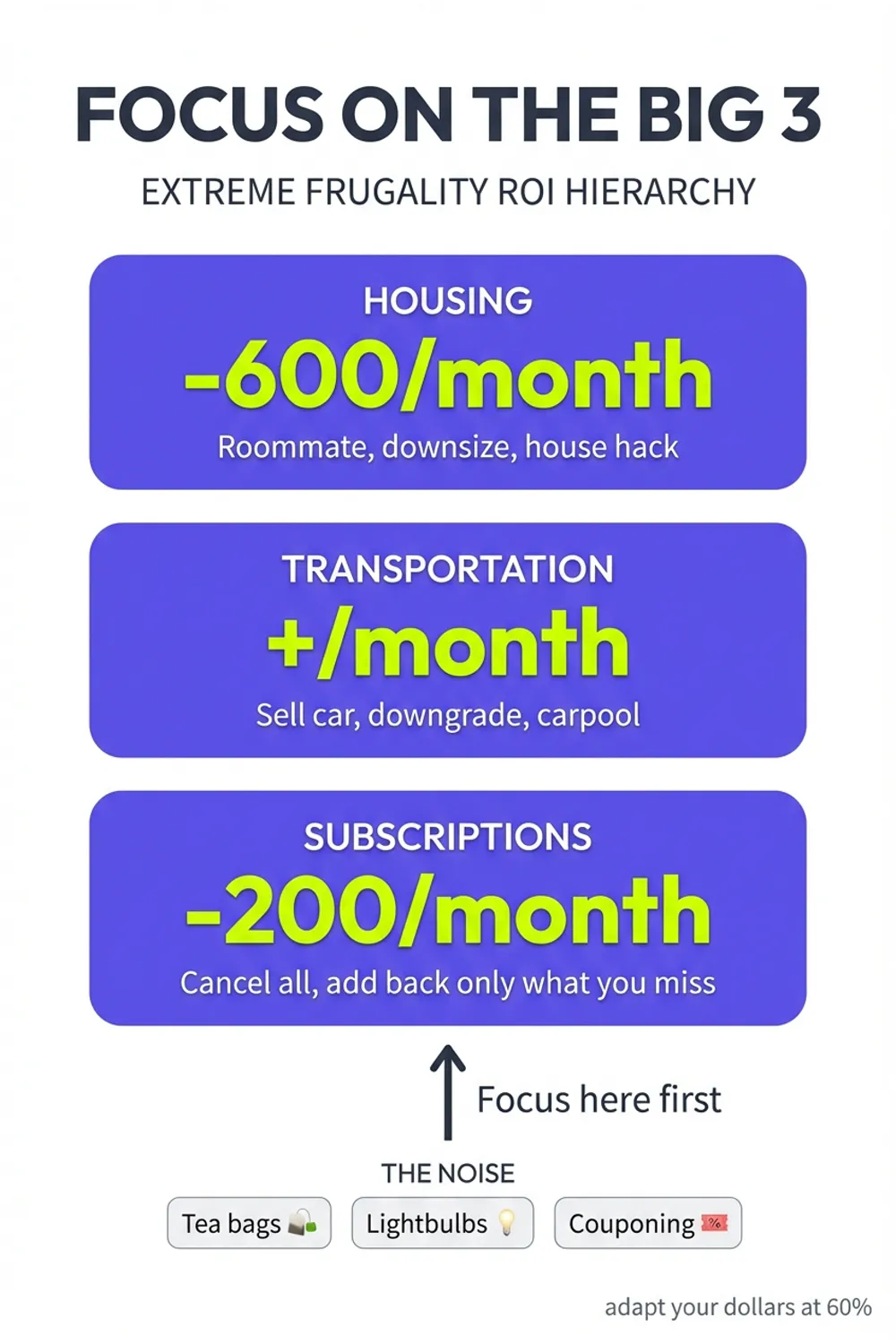

The 5-Star Moves vs. The Penny-Pinching Waste of Time

Not all frugal tactics have the same ROI. Some take 5 minutes and save $400/month. Others take 2 hours and save $4.

Here’s the breakdown:

| Tactic | Time Investment | Monthly Savings | ROI Rating |

|---|---|---|---|

| Sell car, go car-free | 20 hours upfront | $400-965 | ⭐⭐⭐⭐⭐ |

| Get a roommate | 10 hours upfront | $300-600 | ⭐⭐⭐⭐⭐ |

| Cut all subscriptions | 2 hours | $50-150 | ⭐⭐⭐⭐⭐ |

| Switch to ALDI/discount grocer | 1 hour/week | $80-150 | ⭐⭐⭐⭐ |

| Meal prep Sundays | 3 hours/week | $100-200 | ⭐⭐⭐⭐ |

| Cut cable for streaming | 30 minutes | $95 | ⭐⭐⭐⭐ |

| Downgrade phone plan | 1 hour | $30-50 | ⭐⭐⭐ |

| LED lightbulb swap | 2 hours | $18 | ⭐⭐ |

| Reuse tea bags | Ongoing | $4 | ⭐ |

Focus on the 5-star moves first. The housing-car-subscriptions trifecta is where the real money is.

Once you’ve tackled the big three, there are dozens of unusual frugal tips that actually save money - things like learning your grocery store’s markdown schedule or negotiating at farmers markets. Not the generic “make coffee at home” advice everyone ignores.

If you’re stressing over reusing tea bags but still paying $147/month for cable, you’re doing it backwards.

What $905/Month in Savings Actually Looks Like (3 Real Budgets)

Let’s get specific. Here’s what extreme frugality looks like in real numbers.

Budget 1: Single Person, $2,400/Month Income

Standard spending: $2,400 Extreme frugal spending: $1,495 Monthly savings: $905 (38%)

- Rent (studio with roommate): $550

- Groceries (ALDI, bulk): $180

- Transportation (bus pass): $70

- Phone (Mint Mobile): $15

- Utilities (split): $45

- Internet (split): $25

- Entertainment (library, free events): $10

- Haircut (Great Clips quarterly): $10

- Misc/buffer: $90

- Total: $1,495

Budget 2: Couple, $4,800/Month Income

Standard spending: $4,800 Extreme frugal spending: $2,625 Monthly savings: $2,175 (45%)

- Rent (1BR): $900

- Groceries (ALDI, bulk, minimal meat): $280

- Transportation (1 beater car): $150

- Phone (2 lines, Mint): $30

- Utilities: $85

- Internet: $40

- Car insurance: $90

- Entertainment: $50

- Total: $2,625

Budget 3: Family of 4, $5,500/Month Income

Standard spending: $5,500 Extreme frugal spending: $3,325 Monthly savings: $2,175 (40%)

- Rent (2BR apartment): $1,100

- Groceries (extreme bulk, minimal meat): $400

- Transportation (1 beater car): $180

- Phone (2 lines): $30

- Utilities: $120

- Internet: $40

- Car insurance: $110

- Kids activities (library, parks): $45

- Misc: $300

- Total: $3,325

Notice what these budgets have in common: One housing unit below market rate. One car max. Almost zero subscriptions. ALDI-level groceries. No eating out.

This is doable, but it’s not forever.

Housing: The $300-600/Month Opportunity Hiding in Plain Sight

Housing is your biggest expense. It’s also where most people refuse to compromise.

But here’s the thing—cutting housing by even 20% can save you more than every other tactic combined.

The moves:

Get a roommate. Studio apartments in my city average $1,200. Splitting a 2BR costs $600 each. That’s $600/month back in your pocket. Yes, you lose privacy. Yes, it’s not ideal. But if you’re trying to save $15,000 in a year, this is the move.

House hack. Rent a 3BR, sublet two rooms. Your rent goes from $1,500 to $500 or less. I know people who live rent-free this way.

Downsize aggressively. Moving from a 2BR to a 1BR might save $200-400/month. Moving from a house to an apartment might save even more. The question is: How badly do you want the money?

If you’re new to frugality, start with housing. It’s uncomfortable, but it’s where the money is.

Ditch Your Car, Save $400+/Month (Yes, Really)

AAA says car ownership costs $11,577 per year in 2025. That’s $965/month.

Most people hear that and think, “Yeah, but I need my car.” Maybe. Or maybe you’ve just never seriously considered the alternative.

Option 1: Go car-free. If you live in a city with decent transit, sell the car. Use a bus pass ($70/month), bike, and the occasional Uber. Even with $100/month in rideshares, you’re saving $700+/month.

Option 2: Downgrade to a beater. Sell your $18,000 financed car, buy a $3,000 beater in cash. Your monthly costs drop from $400 (payment + insurance + maintenance) to $150. That’s $250/month saved.

Option 3: Carpool. Split a car with a partner or roommate. Insurance, gas, maintenance—all cut in half.

Turns out, the second-biggest expense in your life might also be the easiest to cut.

Grocery Tactics That Don’t Make You Eat Like a Monk

Food is where most people spin their wheels. They clip coupons, chase sales, meal plan like their life depends on it—and save $20.

Here’s what actually moves the needle:

Shop ALDI or discount grocers only. The USDA says a single person spends $392-465/month on a “low-cost” food plan. At ALDI, you can hit $180-220. The food is fine. The savings are real.

Buy in bulk. Rice, beans, oats, pasta—buy the 20-pound bags. A month’s worth of rice costs $8 instead of $25.

Cut meat to 2-3 times per week. Chicken thighs are cheap, but beans and lentils are cheaper. Going from daily meat to twice-weekly can cut your grocery bill by 20-30%.

Seasonal produce only. Strawberries in December cost $6. In June, they’re $2. Eat what’s in season, freeze the rest.

Meal prep Sundays. Cook once, eat all week. Batch chili, stir-fry, casseroles. This isn’t about Instagram-worthy meal prep containers. It’s about not spending $12 on Chipotle because you’re too tired to cook.

The goal isn’t to eat sad food. It’s to spend $180 instead of $400 without hating your life.

Need a system? Check out our meal planning guide for the step-by-step. And if you’re shopping for one, here’s a realistic $57/week meal plan using actual USDA prices - not those fantasy $20/week plans.

The Death by 1,000 Cuts You’re Ignoring

Subscriptions are insidious because they’re small. $9.99 here, $14.99 there. You barely notice.

But here’s the thing—they add up to $100-200/month for most people.

The 30-day cancel experiment: Cancel every subscription today. All of them. Netflix, Spotify, gym, meal kits, cloud storage, password managers—everything.

For 30 days, use free alternatives. Library for books and movies. YouTube for music. Bodyweight workouts at home.

After 30 days, add back only what you genuinely missed. Most people end up keeping 1-2 instead of 8-10.

Phone plan: You’re probably paying $60-80/month for unlimited data you don’t use. Switch to Mint Mobile ($15/month for 4GB). If you need more data, jump to the $25 plan. That’s $35-55/month saved.

Cable: The average cable bill is $147/month. Streaming services (Netflix, Hulu, etc.) average $52/month. That’s $95/month saved. Or go full extreme: Cancel streaming too, use the library. $147/month back.

Gym: Planet Fitness is $10/month if you need a gym. Bodyweight workouts at home are free. Most $50-70/month gym memberships are aspirational, not actual.

If you want to take this further, try a no-spend challenge for a full month reset.

When Extreme Frugality Turns Toxic (Warning Signs You Can’t Ignore)

Here’s what nobody tells you: Extreme frugality can break you if you’re not careful.

Warning signs you’ve gone too far:

- Social isolation. You stop seeing friends because every hangout costs money. You decline weddings, birthdays, dinners. You’re saving money but losing relationships.

- Mental health decline. Constant anxiety about spending. Guilt over buying soap. You’re so stressed about money that you can’t think straight.

- Binge cycles. You hold out for weeks, then crack and blow $200 at Target. The restriction-binge loop erases your progress.

- Physical health issues. Skipping doctor visits to save the copay. Eating nothing but ramen because it’s cheap. Your body pays the price.

If you’re experiencing any of these, pump the brakes. Extreme frugality is a tool, not a prison sentence.

The 90/10 rule: Cut 90% of your spending ruthlessly. Keep 10% for sanity. That might be $50/month for coffee with friends. Or $30/month for your favorite streaming service. The point is—one small thing that makes you feel human.

Permission to stop: Set milestones. “I’m doing extreme frugality until I save $10,000.” Or “until I pay off this debt.” Or “for 6 months.” Then ease back to aggressive frugality. You don’t have to live like this forever.

The difference between frugal and cheap matters here. Frugal is strategic. Cheap is harmful.

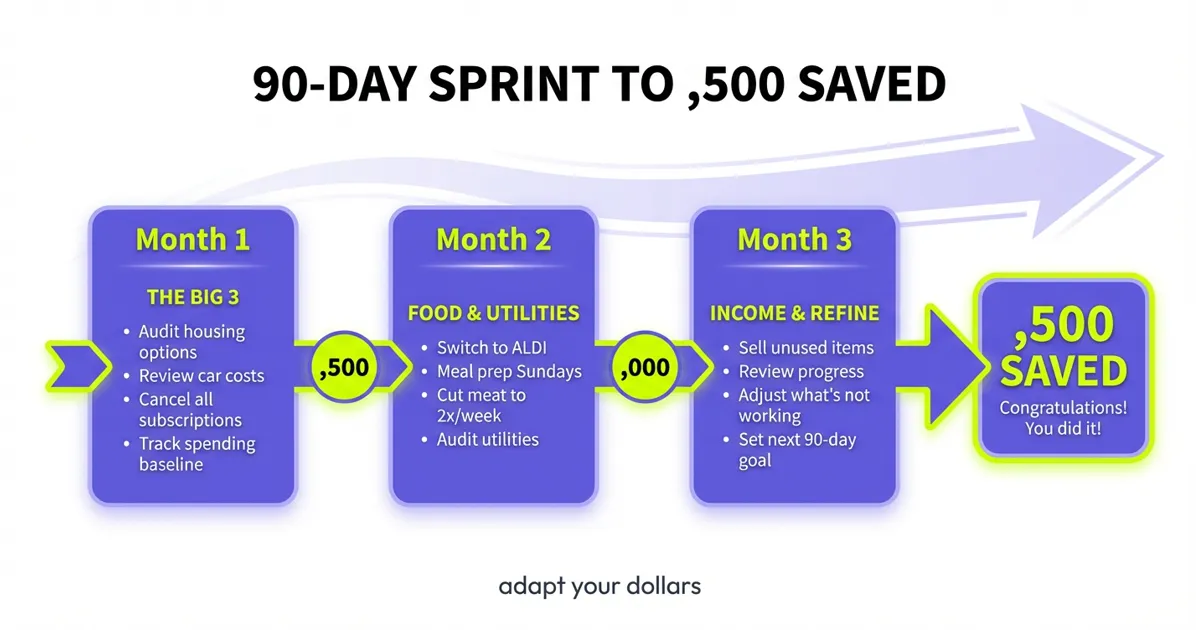

Your 90-Day Blitz: From Broke to $500+ Breathing Room

You don’t need a year-long plan. You need 90 days of focus.

Month 1: The Big 3

Week 1-2:

- Audit housing. Can you get a roommate? Downsize? Move?

- Audit transportation. Can you sell your car? Downgrade? Carpool?

- Cancel every subscription.

Week 3-4:

- Implement housing changes if possible (this might take longer, but start the process)

- List car for sale if going that route

- Track spending for 30 days to establish baseline

Month 2: Food & Utilities

Week 1:

- Switch to ALDI or discount grocer

- Plan weekly meals, buy in bulk

- Cut meat to 2x/week

Week 2-3:

- Set up meal prep routine (Sundays)

- Audit utilities - can you lower heat/AC, swap to LEDs, cut cable? Our guide to unusual frugal tips covers vampire devices, thermal zones, and DIY cleaning products that slash utility costs.

Week 4:

- Refine grocery system based on what worked

Month 3: Income & Refinement

Week 1-2:

- Sell stuff you don’t need (extra $100-500 one-time)

- Look for side income if needed

Week 3-4:

- Review progress—how much are you actually saving?

- Adjust what’s not working

- Set next 90-day goal

The goal isn’t perfection. It’s momentum. If you save $500/month for 90 days, that’s $1,500 in the bank. That’s breathing room. That’s progress.

Time to Sprint (Not Stumble)

You’ve seen the numbers. You know the moves. You understand the guardrails.

Extreme frugality isn’t about deprivation. It’s about focus. It’s about cutting ruthlessly on the things that don’t matter so you can build the life you actually want.

You don’t need to do this forever. Six months of extreme frugality can save you $5,000-10,000. A year can change your entire financial trajectory. But only if you do it with intention and know when to stop.

Pick your top three moves. Housing, car, subscriptions—that’s where the money is. Everything else is noise.

Set your timeline. Three months? Six? A year? Put it on the calendar. This is a sprint, not your new identity.

Track your progress weekly. Every $500 saved is proof this works. Every month you stay on track is momentum you can’t afford to lose.

The grocery bills aren’t getting cheaper. Car costs aren’t dropping. The pressure isn’t going away.

But you can build a buffer. You can save $500, then $1,000, then $5,000. You can give yourself breathing room.

Once you’ve built some savings, you need a system to keep it growing. Our 2026 budget guide has ready-to-use templates for $45K-$75K salaries.

Pick one move from the 5-star list. Do it this week.

Written by

Chris

I went from checking my bank balance before every grocery run to building a $10K emergency fund. Now I share the exact strategies that worked—no jargon, no judgment.